Your guide to the repo rate

Understanding the ups and downs of the repo rate and why it affects your day-to-day finances equips you to make more informed and (potentially) better financial choices. Let’s remove some of the complexity of this concept and its impact on your ability to borrow, save and invest.

What is the repo rate?

The repo rate is short for repurchase rate, which is the rate at which the South African Reserve Bank (SARB) lends money to banks, and it plays a role in monetary policy. In turn, banks lend money to you (in the form of credit and loans), and how much interest they charge to lend that money is influenced and built on the repo rate.

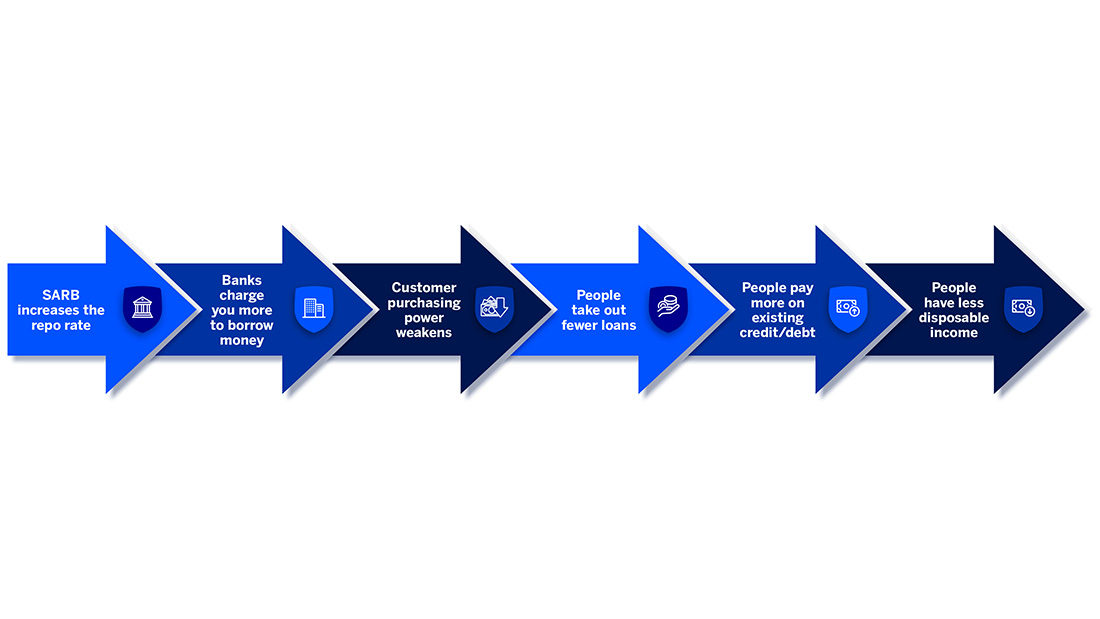

Here’s how a repo rate increase influences the economy.

How does it impact your personal finances?

The repo rate directly impacts your household finances in the following ways:

- Borrowing costs

If the repo rate goes up, it’s more expensive for the bank to lend you money, and thus the cost of borrowing money will go up, with the inverse also being true. This means your personal loans, home loans and credit applications will be impacted.

What to do about it: When the interest rates are high, limit your credit, only borrow what you need.

- Savings and investments

The repo rate leads to increased borrowing costs, but it also affects the rate at which your savings and investments can grow in terms of potential returns.

What to do about it: Typically, financial institutions will offer higher interest rates on savings and investment products to attract customers during high-interest times. Take advantage of such offers and put your money in a notice or fixed deposit savings account to benefit from higher returns.

- Property

Changes in the repo rate can influence bond rates, and when bond rates are higher, it makes it more challenging to become a homeowner as you might have less buying power. Similarly, your home loan can become more expensive to maintain.

What to do about it: If you’re looking to buy a property, you could put down a bigger deposit or consider a smaller or less expensive property. Use our home loan calculator to estimate what you can afford and the difference a larger deposit could make to your home loan amount.

- Day-to-day finances

Since borrowing costs are higher, it means that you’ll spend more of your money to pay down your debt. That means less money available for discretionary and everyday spending, which can also influence your ability to save money as you’ll have less of it spare.

However, if the cost of borrowing decreases, it could free up extra cash that can be used to save more or enjoy more spending power.

What to do about it: Use a budget to manage your expenses carefully and be purposeful about where your money is going. Also get rid of high-interest debt as soon as you can as this will continue to grow and take up more and more of your money unnecessarily.

Make budgeting easy and effective with the Budget Manager add-on on our banking app.

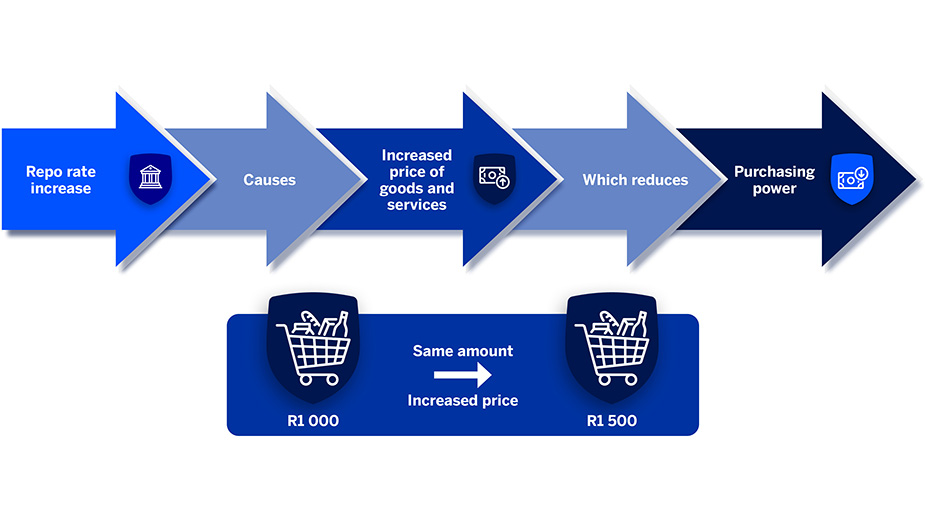

- Your basket could decrease

If the repo rate goes up and interest rates increase, the cost of everything goes up, including your cost of living. That means suddenly it will cost you more to maintain the same lifestyle as before. One example is how your shopping basket could change. If prices increase but how much money you must spend on groceries remains the same, your money’s purchasing power decreases.

Therefore, you’ll have to spend more to get the same, or you will get less for the same amount of money.

*Terms and conditions apply. Network costs only apply to downloading the app.

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.